Why Independently-Aligned Financial Advice Matters for Wealth Preservation, Growth, and Legacy Planning

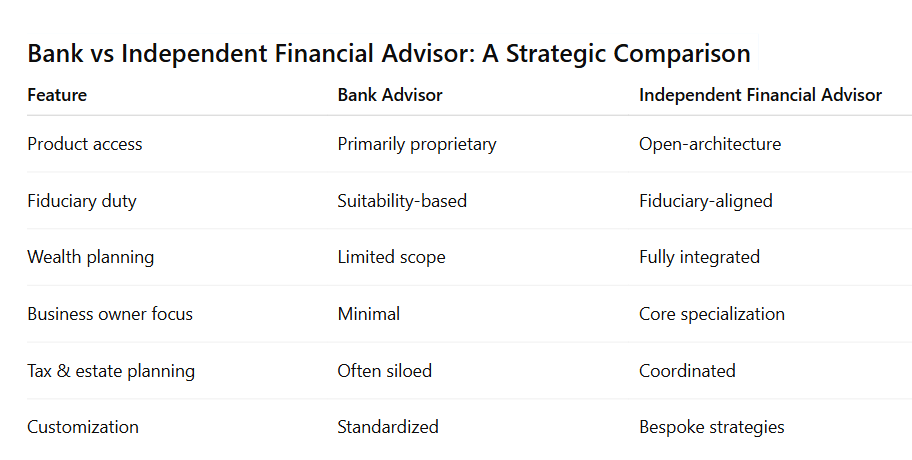

When your financial life involves significant assets, business ownership, or long-term legacy planning, choosing the right financial advisor is a strategic decision — not just a matter of convenience.

Many Canadians start their financial journey with a bank advisor. But as wealth grows, complexity increases. Taxes, succession planning, risk management, and investment strategy begin to intersect.

That’s when many high-net-worth individuals and business owners start asking:

Is a bank advisor still the best fit — or is an independent financial advisor better suited to my needs?

If you have questions or are looking for additional information, please reach out and we CC&Associates, can guide you through the process.

In this article, we are going to explore

Understanding the Bank Advisor Model

What Makes an Independent Financial Advisor Different?

Which Advisory Model Is Right for You?

Our Perspective at CC&Associates

1. Understanding the Bank Advisor Model

Bank advisors are embedded within large financial institutions and typically offer investment and planning solutions tied to that institution’s products.

a) Advantages

Familiar brands and easy access

Convenient for basic banking and entry-level investing

Standardized investment solutions

b) Limitations for Wealthy Individuals

As financial complexity grows, the bank model can present challenges:

Advice may be limited to proprietary products

Planning is often transactional rather than holistic

Less flexibility for advanced tax or business planning

Investment recommendations are typically suitability-based, not fiduciary

For individuals with corporations, holding companies, or significant tax exposure, these limitations can have a material impact on long-term outcomes.

2. What Makes an Independent Financial Advisor Different?

An independent financial advisor operates outside of a bank or proprietary institution. This independence creates meaningful advantages — particularly for high-net-worth individuals and business owners.

a) Fiduciary Advice Focused on Your Best Interest

Independent advisors are often held to a fiduciary standard, meaning advice must be aligned with the client’s best interest — not product sales targets.

This is especially important when decisions involve:

Corporate surplus

Tax minimization strategies

Estate and succession planning

Long-term family wealth preservation

b) Broader Investment & Planning Access

Independent advisors are not restricted to in-house products. This allows for:

Customized portfolio construction

Tax-efficient investment strategies

Coordination across personal and corporate structures

Flexible solutions as your situation evolves

For wealthy individuals, flexibility and choice matter.

c) Integrated Wealth Management for Business Owners

Wealth management for business owners goes beyond investments.

Independent financial planning often includes:

Business succession and exit planning

Corporate insurance strategies

Estate and legacy planning

Coordination with accountants and lawyers

Risk management and continuity planning

This integrated approach reduces blind spots and helps align financial decisions across all areas of life.

d) Deeper, Long-Term Advisory Relationships

High-net-worth individuals often prefer:

Direct access to senior advisors

Long-term continuity

Proactive planning

A trusted partner who understands both business and personal finances

Independent firms are built for relationship-driven wealth management, not volume-based transactions.

3. Which Advisor Is Right for You?

An independent financial advisor may be the better fit if you:

Own or plan to sell a business

Are an incorporated professional

Have multiple income streams

Face complex tax decisions

Want proactive wealth and legacy planning

Value long-term advisory relationships

As wealth grows, the cost of incomplete planning grows with it.

Our Approach at CC&Associates

At CC&Associates, we specialize in working with business owners, professionals, and high-net-worth individuals across Ontario.

Our approach focuses on:

Strategic financial planning

Tax-efficient wealth management

Business succession planning

Long-term risk management

Coordinated advice across all areas of your financial life

We act as a long-term partner — not a product provider.

Choosing between a bank advisor and an independent financial advisor is not about which option is “better” — it’s about which model aligns with your financial complexity, goals, and long-term vision.

For wealthy individuals and business owners, independent advice often provides the flexibility, depth, and alignment required to protect and grow wealth intentionally.

Thanks for reading,

CC&Associates